REVOLUTION OR FAD? WHEN BEEPLE’S EVERYDAYS: THE FIRST 5000 DAYS IS SOLD AT CHRISTE’S THIS WEEK, IT WILL SHOW WHERE THE ART MARKET IS HEADED AFTER COVID-19.

By Power Ekroth 08.03.21 Artikel på svenska

Beeple, Everydays: The First 5000 Days, 2021.

When Christie’s, one of the world’s most prestigious auction houses, recently announced that it would be selling the digital artwork Everydays: The First 5000 Days (2021) by the artist Beeple (Mike Winkelmann), it created a huge interest in the art world. Beeple has 1.8 million followers on Instagram, collaborates with several luxury brands, and has created concert visuals for celebrities such as Niki Minaj and Ariana Grande, but he’s not really a household name within the more traditional art world. The work for sale is a pixelated digital work comprising five thousand ‘Everydays’, images that Beeple has created and published online every day since 1 May 2007. Christie’s is thus breaking new ground, becoming the first major auction house to offer an NFT work (or Non-Fungible Token, a digital fingerprint that secures the work’s originality via blockchain technology) at auction.

The classic auction houses have long thrived as purveyors of exclusivity, with unique physical objects. Their customers have mainly been from an older wealthy generation, but they managed to partially rejuvenate their clientele with so-called “trust fund babies” in the early 2000s, who also secured an interest in artists from their own generation. Now it’s time to play Simon Says with the new generation of millennials. It is widely known that artists are quick to incorporate societal changes into their art, but the art world is less nimble – more like a large oil tanker, which cannot quickly change course. However, the art world having been hard hit by the pandemic appears to have forced a change.

When art fairs opened digital showrooms, the art market simply had to adapt. Among other things, we have seen greater transparency when it comes to art prices, an area previously shrouded in secrecy. Suddenly, you could see and compare prices of different artworks. But this entailed a loss of exclusivity. At the same time, industries that have already been digitised – such as music, film, and television, as well as the literary world – saw a huge boom in 2020. In short, we spend a lot more time staring at screens than art on walls.

Christie’s is not making this move in a vacuum; the sale will be a litmus test for what lies ahead, at least in the near future. Because there is certainly no shortage of money. A few days after Christie’s announced its collaboration with Beeple, his digital work Crossroads (2020) was sold on the Nifty Gateway platform for USD 6.5 million (EUR 5.5 million), a record for this type of work. According to the most reliable measuring instrument we have today, the so-called NFT report 2020, the market for NFT in 2020 has reached a total of USD 250 million (EUR 210 million).

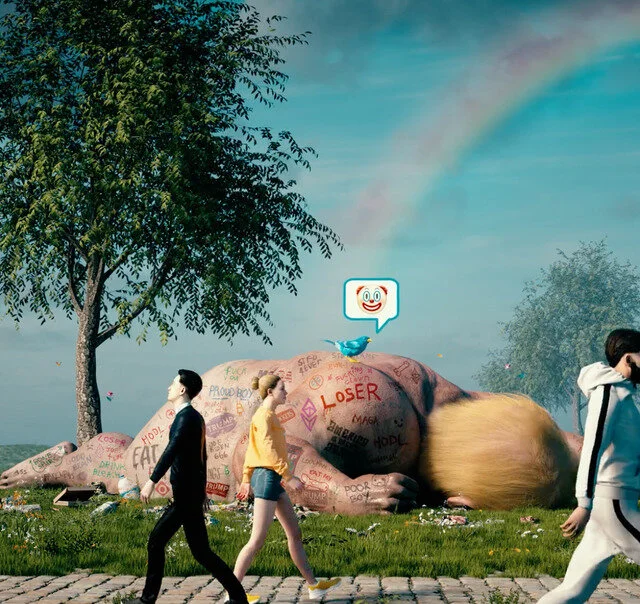

Beeple, Crossroads, 2020.

When Christie’s used the exclusive social media platform Clubhouse to create a buzz around Beeple, the auction house initially maintained that it would not accept cryptocurrency as payment for the digital work. This has since been reconsidered, and it will now be possible to pay in Ether (ETH), the currency of the Ethereum network, probably in response to the significant demand.

Blockchain and cryptocurrency have been buzzwords since around 2016, and in the blockchain world there is talk of how to leverage this trend to create a new utopian world – and art world. Claims that blockchain could be the foundation of a completely equal and colour-blind art world where everyone, including the artist, wins are not uncommon. Through so-called “Smart Contracts,” which are routine within blockchain, a creator is entitled to between 10 and 20 per cent of the purchase price each time the work is sold. A work that is sold on a digital platform is sold in seconds, and can increase in value extremely quickly. This is one of the reasons why the promoters of this type of market are so enthusiastic. They believe that the new digital market is a revolution for the art industry, which will not only become more democratic and less elitist, but also better account for the work’s creator than the more traditional art world.

On the other hand, there’s an awareness both among NFT artists and collectors that the digital marketplace is dominated by men. There are also questions about how democratic and utopian a world founded on cryptocurrency can be, or is likely to become, as long as, for example, internet connection is not a global civil right. Who is actually included in the conversation, and who is excluded?

Beeple, Everydays: The First 5000 Days (detail), 2021.

The exponential increase in the value of NFT works on platforms such as Rarible, Nifty Gateway, and Open Sea has attracted a completely new type of art collector who has never been interested in the more traditional art market. Older generations have difficulty understanding the digital art market and have not previously felt threatened or even seemed to care. Many also believe that digital art does not really achieve what is considered “good quality” in a work of art, at least not yet. The art market, in the words of American art critic Jerry Saltz, is similar to a happy Labrador puppy who is just as happy and excited no matter who pays attention to it, and many believe that this is just a fad.

The temptation to own an NFT work can also be difficult to understand, because what exactly do you get when you buy a digital work? A series of numbers that is added to your digital wallet, and a JPEG? Anyone can easily make exact copies of works, so how can collectors then brag about owning them? While some choose to buy framed screens to display their works on the wall, others are content to display them on their phone or computer screen; a third type of collector sells the work immediately. An interest in capital rather than art still dominates the NFT world. But as history has shown, collecting art is a desire that can generate both more interest and discernment.

Obviously, the major advantage of cryptocurrency is that artworks can change owners very quickly. Additional benefits for buyers and sellers include avoiding a lot of administration and operation/handling, such as storage, maintenance, packaging, hired expertise for damage assessment and the transportation of artworks – because in the end it’s basically just a transfer of capital. Of course, another critique is connected to this type of transaction, as cryptocurrency has become a favourite in the market’s shadier parts. It is still unclear whether these sorts of deals will be able to support or prevent money laundering in the future.Currently, nobody knows how this will affect the art world. With whispers estimating a final price of USD 50 million (EUR 42 million), the end result of Christie’s big experiment will, this Thursday 11 March, in any case indicate a direction. In the wake of this, many will feel encouraged to try to create their own market. But the important thing is, of course, not the amount of money, but the consequences of a technology that guarantees the authenticity of a digital work.

Beeple, Everydays: The First 5000 Days (detail), 2021.